Tugende Limited, a for-profit social enterprise that helps motorcycle taxi drivers in Uganda own their motorcycles via a lease-to-own model, has acquired a US $5 million (about Shs18.5 billion) loan from The Overseas Private Investment Corporation (OPIC), a U.S. Government agency that helps American businesses invest in emerging markets.

According to an official statement, Tugende, “will use the OPIC loan to scale up its successful operations in Uganda, and offer a path to ownership and higher income for many more of the estimated one million full-time motorcycle taxi drivers in East Africa.”

Tugende was started six years ago by Michael Wilkerson who had come to Uganda for a journalism internship program at the Daily Monitor.

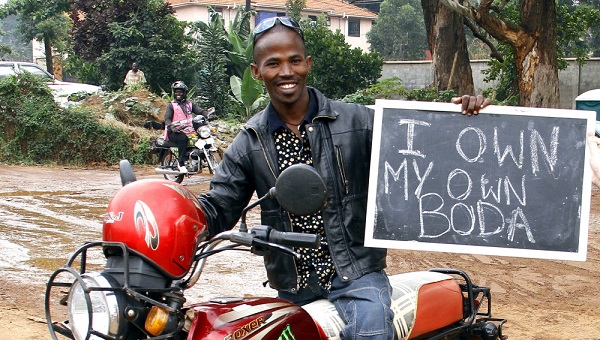

With Tugende, after a rigorous selection process, a boda-boda rider is given a motorcycle of their choice at a lease-to-own arrangement; the lease is then paid back weekly over a 19-month period with principal and interest components. Payment is by way of mobile money and PayWay, nothing else, according to a statement on the Tugende website.

Must read: Tugende CEO, you can never declare victory on financial inclusion

The startup currently employs over one hundred people distributed in Kampala, Mbale, Jinja, and Mbarara, according to information on the company website. It has so far served more than 12,000 customers — 5,000 of whom have already purchased their motorcycle taxis outright.

Senior journalist Andrew Mwenda, according to Tugende was the first investor in the startup, and he currently serves as the director and advisor.

Speaking on the development, Ray W. Washburne, OPIC President, and CEO, said: “By supporting Uganda’s boda drivers, we are empowering local entrepreneurs while also helping to strengthen a key mode of transportation in Uganda.”

He added, “This project will advance OPIC’s new Connect Africa initiative to invest in transportation, technology and value chains across the continent.”

On his part, Tugende Founder and CEO Michael Wilkerson said: “Bodas are a key source of transportation in Uganda, but for boda drivers and many other small businesses operators access to capital has always been the biggest challenge.”

He went on, “OPIC’s financing will help us provide financial security, asset ownership and higher income for thousands of additional drivers and improved quality of life for tens of thousands of their family members.”

Related:

Africell secures Shs386bn loan to support network expansion

SafeBoda reveals next country it is expanding to after Kenya