Airtel Money charges for transferring money from your bank account to your mobile wallet have been more than tripled, shortly after the telco announced it was reducing the fees for sending money among Airtel Money users.

Earlier this year, MTN Uganda also raised its bank to mobile money tariffs by percentages in the neighborhoods of what Airtel Uganda has done.

However, for Airtel to increase its digital money transfer charges shortly after rolling out a promotion that it said was aimed at boosting financial inclusion reeks of hypocrisy.

According to the new Airtel Money charges, for small amounts of money, the sending fees have been either reduced or maintained. But from above Shs60,000, the charges were dramatically increased.

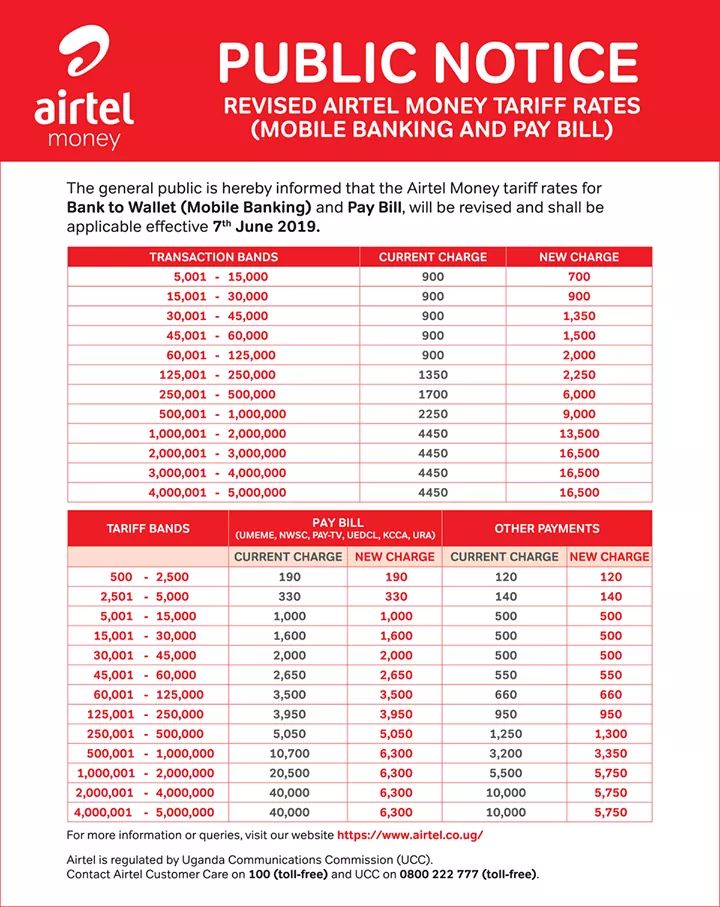

To send an amount from Shs5,000 to Shs15,000 from your bank account to your mobile wallet, the fee is currently Shs900 but it will reduce to Shs700 on June 7, 2019. For amounts from 15,001 to 30,000, the tariffs were maintained at Shs900.

For some range of figures, the rates were increased by 50% while in some ranges, the rates went beyond 100%. For instance, to send any amount from Shs60,001 to 125000, Airtel currently charges Shs900. According to the new Airtel Money charges, you’ll start paying Shs2,000, an increase of 122.2%.

If you think that’s the highest percentage increment, then you need to see what you’ll pay to move any amount above the aforementioned figures.

For instance, transferring an amount between Shs250,000 and 500,001, it currently costs Shs1,700. The new rates put the cost at Shs6,000, a difference of 4,300 and a percentage increment of 253%.

To move any amount between Shs4 million to 5 million, it currently costs Shs4,450, according to the new Airtel Money charges, you’ll begin paying Shs16,500 to transfer an amount in that range. This is a percentage increment of 271%.

Comparing with MTN Mobile Money with Airtel Money

When you are moving small amounts of money, banking with Airtel Money is the ideal option. Why? Because with MTN Mobile Money, from Shs5,000 to Shs125,000, you’ll be charged Shs1,500. (Click here to see current MTN bank to mobile wallet charges.)

But with Airtel Money, you can send an amount below Shs45,000 for less than that (see table at the end of the story).

Then, after that, Airtel starts charging what MTN charges in some ranges or even more.

For instance, both MTN and Airtel charge Shs9,000 to send any amount in the range of Shs500,000 to Shs1 million. The costs of sending from Shs250,001 to less than Shs500,000 are also the same. Even between Shs2 million and Shs5 million.

But Airtel will charge you more to send Shs125,000. While MTN charges Shs1,500 for that figure, Airtel charges Shs2,000.

Payments

For making payments, both Airtel Money and MTN Mobile Money charge the same amounts in most ranges. (Refer to the table for Airtel charges and click here to see MTN rates on payments.)

But Airtel Money is cheaper in some ranges, going by the forthcoming Airtel Money charges.

For instance, when making a payment between Shs2,500 and Shs5,000, Airtel charges Shs330 while MTN wants Shs600. Also, when making a payment between Shs250,000 to Shs500,000, MTN charges Shs5300 while Airtel will charge you Shs5,050.

Note: Airtel has reduced the rates for making payments.

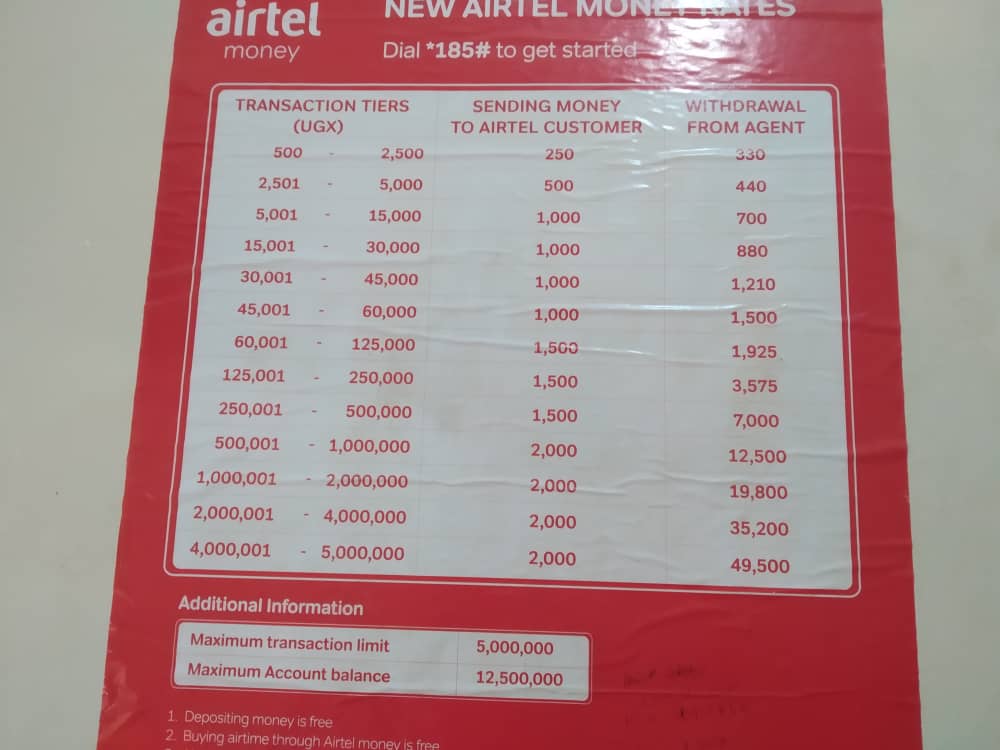

See sending and withdraw rates